Broke Millennials Find Salvation in Modern Communes

Co-housing is emerging as a smart solution for urban living, allowing multiple people to share mortgage payments and build supportive communities. Pooling resources for housing can make prime real estate more accessible and transform property ownership from a dream into reality. When considering co-housing, ensure solid agreements are in place and seek housemates aligned with shared values and interests for a successful living situation.

China's Property Market: Turning Houses into Homes (and Money into Magic)

China's housing market shows signs of recovery with government backing, making buying homes more accessible. Local governments are revitalizing urban areas with funding for idle land and housing, creating opportunities for buyers. New financial support and easier lending are encouraging property investment, turning the market into a hopeful landscape.

ASX Dividend Stocks: Your Bank Account's Rebound Therapy

Investing $5,000 in top ASX dividend stocks like Adairs, Centuria, and GQG Partners can yield impressive returns, with some stocks boasting yields up to 12.2%. Diversifying your investments across multiple dividend champions helps mitigate risks while enhancing potential capital growth. These dividend darlings offer a tasty alternative to low-yield savings accounts while providing steady income and growth opportunities.

Inflation and Tariffs Join Forces to Create America's Hottest Real Estate Reality Show

With 3% inflation and looming trade tensions, investors should brace for economic volatility. Real estate and recession-resistant sectors like healthcare and utilities are emerging as safe havens in a turbulent market. Diversifying your portfolio is crucial to navigate this economic landscape and uncover hidden investment opportunities.

Dividend Hunters Face Off Against Inflation Monster

Dividends and REITs are vital for combating inflation, with Coca-Cola leading a wave of companies increasing payouts. Diversifying your portfolio with global stocks and REITs is essential for financial stability amidst interest rate hikes. Dividend-paying stocks and REITs are your best bet for steady income and peace of mind in today's volatile market.

Magnificent 7's Crown Gets Heavy as DeepSeek Crashes Tech Party

The Magnificent 7 (Mag-7) tech giants are facing challenges as competition grows and profit margins shrink. Investors are encouraged to diversify their portfolios beyond tech stocks, considering sectors like real estate, healthcare, and finance. Despite their impressive status, even market leaders need a supporting cast to navigate potential downturns.

Elon's AI Brain Gets a Southern BBQ Home as Dubai Goes Digital with Real Estate

Elon Musk's xAI is set to build a massive supercomputer facility in Memphis, combining tech innovation with Southern charm. The ambitious project promises a boost to local real estate values and eco-friendly initiatives amidst concerns about its energy consumption. Investors should scout tech hubs like Memphis and follow trends such as real estate tokenization for future opportunities.

Real Estate Market Gets a Cold Shower as Interest Rates Play Hard to Get

The 2025 real estate market is tough with homes selling at significant discounts, but buyers are wary of high prices and interest rates. The Federal Reserve hints at possible interest rate cuts, but economic uncertainty risks instability in the housing market. Personal savings are dwindling, while global housing trends vary, suggesting location greatly affects real estate success.

Housing Market: Interest Rates and Home Prices Play Hide and Seek

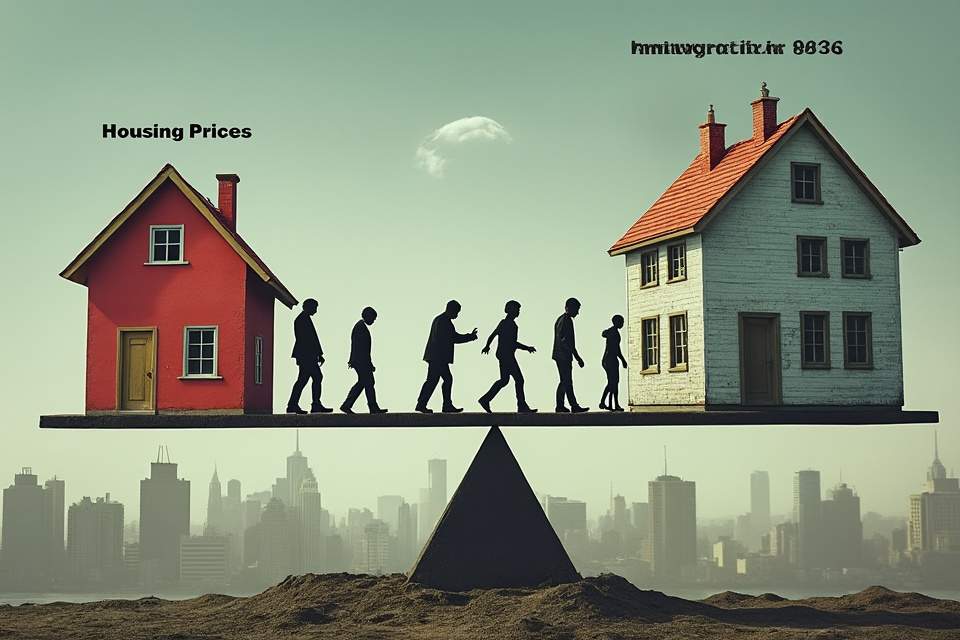

The housing market in 2025 remains unpredictable with rising home prices and fluctuating interest rates, urging potential buyers to be financially prepared. In the UK, home prices are expected to rise by 3.5% despite a decrease in the Bank Rate, while first-time buyers may benefit from lower mortgage rates amidst a stagnant economy. The U.S. real estate market is experiencing declining home prices concurrently with high mortgage rates, pushing more people towards an increasingly competitive rental market.

Trump's Trade Tantrum Torpedoes Real Estate Rally

New tariffs could increase U.S. home construction costs by $5,000 to $7,000, causing concern in the real estate market. The Dow dropped 1.8% amid Trump's tariff strategy, prompting companies like Ford to warn of potential supply chain disruptions. Traders are pivoting away from international sectors as Canada, Mexico, and China face looming tariffs and ongoing geopolitical tensions.

Tokenization Takes Over: Old Money Gets A Digital Face Lift

Traditional finance is embracing cryptocurrency with Euronext expanding to handle crypto ETPs. Tokenized assets reached $50 billion in 2024, with real estate dominating the market. Luxury items like yachts are now fractionalized on the blockchain, revolutionizing investment opportunities.

Real Estate Giant's Rs 2,434 Crore Oopsie Makes Investors Question Life Choices

Jai Corp. is embroiled in a Rs 2,434 crore fraud case, exposing a web of shell companies and poor due diligence. The real estate sector faces significant trust issues, leading to potential slowdowns in projects and buyer hesitation. Calls for stricter regulations and enhanced transparency are growing, as stakeholders demand reforms to restore confidence in the industry.

Home Sweet Unaffordable Home: Global Housing Markets Play Hard to Get

The median age of U.S. homebuyers is now 56, with first-time buyers below 25% as homeownership becomes a luxury. British housing prices are expected to rise 3.5% in 2025 due to anticipated rate cuts, though still unaffordable. New Zealand's housing market shows recovery with a forecasted 5% price increase, but costs remain high, making investment in rentals a smart move.

Qatar's Real Estate Rollercoaster: PMI Climbs as Construction Naps

Qatar's non-oil sector is booming, with the S&P Global PMI rising to 51.0, indicating rapid economic diversification. While retail and wholesale sectors thrive, the construction industry faces challenges with declining new business activity. Despite rising wages, real estate prices continue to fall, and the future market success hinges on the non-oil sector's growth and flexibility in strategies.

BlackRock Plays Monopoly with Panama Ports: $22.8B Edition

BlackRock acquires majority control of Panama Ports for $22.8 billion, a significant move in global trade logistics. This deal shifts key maritime influence away from Chinese control, aligning with U.S. geopolitical interests. Investors should watch for potential ripples in the shipping sector as infrastructure investments reshape global trade dynamics.

Uncle Sam's $22.8B Panama Canal Power Play Makes China's Head Spin

BlackRock's $22.8 billion acquisition of Panama Ports signals U.S. intent to counter Chinese influence in a strategic trade route. Controlling 90% of Panama Ports, BlackRock teams up with Global Infrastructure Partners to dominate global shipping traffic. This move illustrates the growing significance of infrastructure investments amid geopolitical tensions, with BlackRock treating assets like solid gold.

The Great Real Estate Squeeze: First-Time Buyers Left Holding Empty Piggy Banks

In 2024, only 25% of home purchases were made by first-time buyers, with the average buyer age reaching 56 years. U.S. home prices rose 3.9% in December 2024, requiring an annual income of $124,150 to afford a median-priced home, far above the average income of $79,223. Without significant government intervention, younger generations may need to rely on wealthy relatives or tech careers to afford housing, or adapt to multi-generational living.

Luxury Hotels Chase Serenity: Japan's Countryside Gets Fancy Pants Upgrade

Luxury hotel chains like Mandarin Oriental are shifting focus from major cities to Japan's tranquil countryside, reshaping real estate trends. Investors are now targeting underdeveloped areas in both Japan and New Zealand, aiming for future hotspots as luxury accommodations flourish. Today's quiet rural spots could transform into tomorrow's luxury resorts, making savvy investments in remote locations more appealing than ever.

North East's Real Estate Party Crashes National Economy's Pity Fest

The North East region is thriving with real estate growth as Amazon opens its first UK drone delivery hub in Darlington and local firms invest heavily. Despite the overall US economy struggling with low consumer confidence and inflation fears, the North East's industrial sector remains a promising investment opportunity. Investors should approach the North East market with optimism, but stay vigilant about national economic indicators and potential risks.

Family Business Goes Bananas: CDL's Father-Son Power Struggle Rocks Singapore Inc.

CDL's Kwek family is embroiled in a court battle over governance disputes, with patriarch Mr. Kwek Leng Beng opposing his son Sherman over alleged board mismanagement. Share trading has been halted as minority shareholders watch the billion-dollar family drama unfold, highlighting the importance of good corporate governance. Investors are advised to consider the risks of family-run businesses, as internal conflicts can jeopardize shareholder value and company stability.

Home Sweet Equity: America's $11.2 Trillion Piggy Bank Collects Dust

Americans have $11.2 trillion in untapped home equity, averaging $319,000 per homeowner, yet most hesitate to access it. Current mortgage rates at 6.85% are causing a 'lock-in effect', preventing homeowners from cashing out or moving. This stagnation creates investment opportunities in rental properties, as many choose to rent instead of buy amidst high rates.

Real Estate's Perfect Storm: Interest Rates, Red Tape, and ESG Headaches

High interest rates are making home buying challenging, with many opting to stay at home and save instead. Investment firms are reevaluating their ESG strategies, pushing real estate to focus more on sustainability for profit. Savvy investors should adapt to market changes and prioritize affordable housing and logistics in their portfolios.

Interest Rates: Fed Takes a Nap While Europe Hits Snooze

The Federal Reserve takes a break from rate hikes while the European Central Bank plans to slash rates, possibly weakening the euro against currencies like the Swedish krona. The Bank of Japan joins the rate-hiking trend amidst concerns over rising debts and slowing economic growth. Investors should watch regional interest rate differences and emerging sectors influenced by cheaper loans, as the global financial landscape evolves.

Singapore's Real Estate Safari: PM Wong Takes Property Bulls By The Horns

Singapore's 2025 Budget aims to keep housing affordable, focusing on stabilizing HDB prices and increasing supply exclusively for locals. Real estate firms are urged to embrace technology with AI and virtual reality, moving away from traditional practices. With a push for eco-friendly buildings and potential carbon taxes, sustainability is becoming a crucial factor in property investments.

Dividends and REITs: Your Portfolio's Secret Money Piñata

Dividend stocks and REITs can significantly boost your retirement portfolio amid inflation, providing attractive income streams. General Motors' 25% dividend increase and the strong yields from REITs like EPR Properties make them appealing investments. Remember to focus on sustainable yields and diversify your investments to effectively combat inflation in today's market.

Singapore's 60th Birthday Gift: A Not-So-Subtle Reminder to Start Investing

Invest in dividend-paying stocks like REITs to combat rising living costs and inflation. Diversify globally with companies like Hongkong Land to create multiple income streams. Start investing early to harness the power of compound interest and secure your financial future.

New World's $852M Loss vs Indonesia's $900B Fund: Money Moves That Make You Go Hmm

New World Development faces a critical cash flow crisis, reporting an $852 million loss in the first half and deep debt issues, raising concerns among investors. In stark contrast, Indonesia's Danantara is thriving with a $900 billion sovereign wealth fund, highlighting the importance of governance and strategic planning. These contrasting financial scenarios illustrate key lessons on transparency and effective management in investment.

Fed's Housing Plot: High Rates Make Home Dreams Go 'Poof!'

High interest rates are turning the housing market from hot to cold, making home buying feel unaffordable for many. Potential buyers should keep an eye on interest rates, focus on job-rich locations, and consider alternatives like REITs. Smart investors can still find opportunities in the market by being patient and strategic despite the current economic chill.

Vegas Real Estate King VICI Hits Jackpot as Interest Rates Go All-In

VICI Properties combines the glitz of Las Vegas real estate with steady income, collecting rent from top casinos even during downturns. With a 5.5% dividend yield and investment grade status from Moody's, VICI is a solid choice for income-focused investors. They're expanding their portfolio beyond gaming, ensuring revenue with 90% of leases tied to inflation, making them a smart long-term bet.

House Party 2025: Too Many Homes, Not Enough Buyers

The US housing market has a record high of 496,000 homes for sale, up 8.3% from last year. Despite the surplus, home prices continue to rise, with a 3.9% increase noted in December 2024. Builder confidence is low due to rising construction costs, making affordability a persistent challenge.

Family Fortune Fiasco: CDL's Top Floor Father-Son Face-off

City Developments Ltd is embroiled in a dramatic boardroom clash as CEO Sherman Kwek's move to add independent directors triggers a family feud with his father, executive chairman Kwek Leng Beng. CDL's financial stability is threatened by this conflict, impacting both investor confidence and the broader Singapore real estate market. Investors should monitor CDL's governance developments closely and consider diversification strategies amid the unfolding drama.

Singapore's Media Tussle Goes Bungalow-Sized

Singapore ministers sue Bloomberg over defamation regarding property dealings, highlighting issues of transparency. As investment firms critique corporate governance, the property's market landscape faces potential shifts from ongoing legal battles. Investors must prioritize diligence and stay informed, as upcoming legal proceedings could impact future property discussions in Singapore.

Sempra's Energy Empire: Billions Spent While Bean Counters Sweat

Sempra's 2024 outlook shows a dip in net income to $2.82 billion, but adjusted earnings rose to $2.97 billion, reflecting strong performance in utility investments. The company's ambitious $56 billion capital plan focuses on upgrading aging infrastructure, particularly in Texas with a 27% surge in transmission requests. Sempra's Port Arthur LNG Phase 2 project, backed by Saudi Aramco, is set to drive growth, while adjusted EPS guidance suggests stable returns for investors through 2026.

From Dunder Mifflin to Dollar Bills: Mindy Kaling's Real Estate Empire

Mindy Kaling has transitioned from her role on 'The Office' to becoming a real estate mogul with a net worth of $35 million. Despite a setback with a condo sale, Kaling is making savvy investments, highlighted by her recent $15 million Beverly Hills purchase. Her journey emphasizes that success in real estate requires market knowledge and strategic planning, not just celebrity status.

Immigration Policy Shuffle Leaves Real Estate Markets Playing House

Canada and Australia are reducing immigration targets to manage housing market pressures, with Canada cutting permanent residency goal from 500,000 to 395,000 by 2025. Despite adjustments in immigration policies, chronic supply shortages mean housing prices are unlikely to drop significantly. Investors should view these changes as a temporary breather, not a major shift, and stay focused on areas with historical scarcity.

Southern Real Estate Giant Cousins Properties Dodges Market Bear Hugs

Cousins Properties (CUZ) impresses analysts with a strong financial performance and a 12-month price target of $33.62 amidst market uncertainties. With a solid revenue growth rate and manageable debt, CUZ stands out as a reliable investment in a competitive yield environment. Strategic positioning and a diverse tenant base make CUZ a potential cornerstone for investors seeking stability in turbulent markets.

Retirement Blues: Your Savings Account Isn't Playing Nice

45% of American households are inadequately saving for retirement, relying heavily on 401(k)s and IRAs as pensions decline to 11%. Financial literacy is key: prioritize essential spending and review subscriptions to boost savings. Diversify investments and explore tax-efficient accounts for a more secure retirement plan; start building your financial future now.

401(k)ay, Boomer: America's Retirement Crisis Gets Real

45% of American households risk outliving their retirement savings; traditional pensions are nearly extinct. Homeownership may provide retirement stability through options like downsizing and reverse mortgages. Diversifying your retirement portfolio is crucial; enhancing access and incentives is needed for better planning.

Singapore's Property Frenzy: Tampines Project Sells Faster Than Hot Dim Sum

Parktown Residence in Tampines sold 87% of its homes in a single weekend, highlighting Singapore's booming real estate market. The development's prime location and integrated amenities make it a magnet for both local and foreign buyers. Singapore's urban transformation and integrated lifestyle hubs are reshaping modern living, making quick decisions crucial for potential homeowners.

Yellowstone Cowboys Face Reality: Property Tax Bills Don't Pay Themselves

The series '1923' highlights the modern struggles of landowners through the Dutton family's battle to retain their ranch amid environmental challenges and property rights drama. Modern farmers can learn valuable lessons from the Duttons about balancing traditional methods with sustainable practices in today's agricultural landscape. The show serves as a reminder that land ownership involves not just deeds but also the challenges of profit, preservation, and responsible stewardship.

Storage Wars: Midwest Becomes Climate-Safe Haven for Box Empires

The Midwest is emerging as a climate-resilient hub for self-storage, with cities like Cleveland and Indianapolis leading the way. Big storage companies are shifting investments from risky coastal areas to the Midwest, where less than 10% of new listings face significant climate threats. As demand for storage grows due to increased urban density and climate awareness, Midwest facilities are thriving while coastal properties face disaster risks.

Midwest Real Estate: The Hot New Climate Insurance Policy

The Midwest is emerging as a real estate hotspot due to its lower climate risks compared to coastal areas. Homebuyers are drawn to Midwest cities like Cleveland and Minneapolis for their stability and attractive insurance profiles. As traditional desirable locations face environmental threats, the Midwest is positioning itself as a safe and appealing investment choice.

Inflation's Spicy Hot Pot Boils Over in 2025

Inflation is hitting wallets hard in 2025 as investors navigate a volatile market with mixed signals. The Federal Reserve struggles to manage stubborn inflation while the housing market shows signs of deflation. Diversification remains essential in a market filled with both opportunities and risks amid ongoing economic uncertainty.

Home Buyers Play Hide and Seek with Interest Rates

Mortgage rates slightly declined to 6.85%, but remain high, keeping home ownership challenging. Homes are taking an average of 57 days to sell, with prices rising modestly at 3.7% year-over-year. The Federal Reserve is cautious in changing rates, indicating a need for buyers and sellers to strategize in this unpredictable market.

House Market Sees More Mood Swings Than Interest Rates

UK property prices rose 4.6% annually but face pressure from rising inflation, complicating the mortgage landscape. Australia's housing market may benefit from potential interest rate cuts, making homeownership more accessible for buyers. Investors should diversify their portfolios and stay vigilant on economic indicators as the real estate market remains highly unpredictable.

AFG's Board Gains Two Juniors: Not Your Average 'Take Your Kid to Work Day'

American Financial Group welcomes Craig Lindner Jr. and David L. Thompson Jr. to its Board of Directors, blending family ties with financial expertise. Their extensive backgrounds in real estate and insurance suggest AFG is making smart leadership choices amid market volatility. The appointments could signal a shift towards stability and experience-driven leadership in the finance sector, potentially calming jittery investors.

Tax-Free Paradise: Canadian TFSA Investors Eyeing Juicy 2025 Stock Picks

Canadians can now contribute an extra $7,000 to their TFSAs, opening doors to investment opportunities. Granite REIT offers enticing metrics and a 5% dividend yield, making it a strong real estate investment. Brookfield Corp is trading below its value, presenting a discount opportunity for savvy investors.

Three Tax-Free Money Machines That Won't Land You in Prison

Canadians should consider the new $7,000 TFSA limit for 2025 and invest in solid Canadian stocks. Granite REIT offers a 5% dividend yield, TD Bank is undervalued post-fine, and Brookfield Corp is trading below its net asset value. These stocks promise growth and income without the risks of high-volatility investments like cryptocurrency.

Fed's Cold Feet Send Asian Real Estate into Hot Mess

Asian markets are feeling the sting of the Fed's cautious approach, leading to investor uncertainty. China's real estate sector is seen as a clearance sale opportunity despite a significant drop in inbound investment. Amid trade tensions, investors are diversifying, with some looking towards India's stability and others betting on China's potential recovery.

Central Banks Play Hot Potato with Global Economy

Central banks are grappling with inflation and monetary policy, with ECB's Schnabel and Panetta showcasing opposing views on the economic outlook. The Fed faces persistent inflation challenges despite efforts to lower rates, causing strain on consumers and businesses. Investors are flocking to gold and silver as safe havens amidst market volatility, underscoring the need for flexible investment strategies.

Mortgage Rates Play Hide and Seek with 7%

Mortgage rates have stabilized, with 30-year fixes at 6.97% and VA loans at 6.35% as of February 2025. The Federal Reserve has cut rates, but only a couple more quarter-point reductions are expected this year. Shopping around for mortgage rates is essential to find the best deal, as differences can save you a significant amount.

Trump's Tariff Tango Makes Real Estate Market Go Bananas

The U.S. plans a 25% tariff on imports, shaking up markets and raising concerns for builders. Inflation persists like an unwelcome guest, complicating economic stability and homebuyer confidence. Amid geopolitical tensions, savvy investors are seeking opportunities in affordable housing and tech-enhanced properties.

Brookfield's $30 Billion Hidden Stash Gives Singapore REITs FOMO

Brookfield has uncovered $30 billion in carried interest within its asset management business, equating to about $21 per share. The company plans to realize $11.5 billion of this interest over the next five years, backed by a strong performance track record. Meanwhile, Singapore's retail REITs are adapting and thriving despite predictions of retail decline, offering investors robust opportunities.

UK Housing Market's High-Stakes Hot Potato: Inflation Delivers A Fresh Twist

Britain's inflation has surged to 3%, creating uncertainty in the housing market and pushing mortgage rates higher. UK house prices rose 4.6% year-on-year, with Northern Ireland seeing a remarkable 9% increase, but persistent inflation could dampen this momentum. Potential homebuyers should consider locking in fixed-rate mortgages soon, as economic conditions may lead to tougher financial landscapes ahead.

Banking's Game of Thrones: HSBC Plays East-West While Hang Seng Gets Fresh Blood

HSBC reports a 6.5% increase in pre-tax profits to $32.31 billion but analysts expected better results amid restructuring. Hang Seng Bank welcomes new chairman Edward Cheng, signaling potential strategic moves as HSBC reorganizes its operations. Investors should closely monitor how these leadership changes impact profitability and market dynamics over the coming quarters.

Builders Throw Tantrums as Tariffs Threaten Their Sandcastles

Homebuilder confidence plummeted to its lowest since New Year's due to proposed tariffs on construction materials. Starting March 12, new tariffs on steel and aluminum will likely squeeze profit margins and elevate construction costs. With high mortgage rates and rising material costs, the spring housing market looks bleak, prompting investors to tread carefully.

Cardiff's Cardo Takes Big Bite Out of Scottish Property Pie

Cardo Group continues its aggressive expansion by acquiring North Lanarkshire's Rodgers & Johnston, demonstrating that geographical boundaries are merely suggestions for growth. This merger aims to blend Cardo's technical expertise with R&J's maintenance skills for housing associations, but quality service amidst rapid growth will be a key challenge. Market watchers should closely monitor whether Cardo can maintain R&J's standards without overextending itself, as the outcome may redefine service quality in the UK real estate sector.

Singapore's Budget Bonanza: Money Rain Over Lion City

Singapore's 2025 Budget features SG$800 in consumption vouchers for households, with extra for young adults and seniors, amid global economic challenges. A 60% personal income tax rebate and a 50% corporate tax rebate are included to offset a consumption tax hike. The government is investing SG$10 billion in climate resilience and aims for a SG$6.8 billion surplus, showcasing strategic economic planning despite low GDP growth projections.

Property Powerhouses Play Matchmaker: Cardo Group Says 'I Do' to R&J

Cardiff's Cardo Group has merged with Rodgers & Johnston, reshaping the UK's property maintenance sector with combined expertise. The merger promises improved services, particularly in Scotland, while maintaining R&J's management for stable customer relations. As government pressures rise, this partnership could set a new standard in property maintenance, proving that collaboration is key.

Welsh Farmers Face Tax Tug-of-War as Property Market Plays Hard to Get

Welsh farmers are rallying against proposed inheritance tax reforms that could complicate passing down family farms and lower agricultural property values. The FUW is meeting Treasury officials to discuss tax relief modifications, fearing significant financial burdens. Gwynedd's housing market has dropped 12% yearly, with local councils imposing tough regulations on holiday homes to boost local housing availability.