Defense Stocks & Tech: Bulls Running for Cover in Bullet-Proof Vests

Wall Street is shifting focus from tech to defense stocks as survival prepping emerges as the investment trend of 2025. Companies like Procter & Gamble are thriving while tech giants struggle, highlighting the appeal of consumer staples in uncertain times. Investors are advised to diversify their portfolios with blue-chip dividends and defense contractors for steady cash flow amidst market volatility.

Brazil's Real Goes Global: SGX and B3's Currency Power Play

SGX and B3 team up to offer 24/7 trading of the Brazilian real, allowing traders to hedge against Brazil's economic fluctuations. Brazil's government removes import taxes on essential goods to combat inflation and boost market stability. This collaboration simplifies access to trading emerging market currencies, presenting new opportunities for investors eyeing Brazil's economic growth.

Crude Oil's Latest Mood Swings Leave Traders Reaching for Aspirin

Oil prices are swinging wildly with Brent crude at $70.25 and WTI at $66.87, amid ongoing tariff tensions and mixed signals from OPEC+. Traders should watch the critical support level of $66.88 to avoid deeper losses, while resistance between $67.50 and $67.70 is key for potential rallies. Navigating the oil market requires flexibility and patience, with smart traders staying alert and ready for sudden shifts.

Trump's Tariff Tango Makes Oil Producers Sweat Bullets

U.S. commodities markets are facing chaos as Trump's tariffs and capital constraints lead to supply chain disruptions and unstable job numbers. WTI crude prices have plummeted to $65 per barrel as OPEC+ increases production against falling demand. Traders should stay alert on supply chains, evaluate resilient oil stocks, monitor geopolitical risks, consider gold as a hedge, and prepare for ongoing market volatility.

Fed's Recipe: Mix 3% Inflation with a Dash of Tariff Threats

The Federal Reserve is hesitating on interest rate adjustments while inflation persists at 3%, reflecting uncertainty in the economic landscape. The yield curve has inverted, signaling potential recession concerns, but some analysts are viewing it as a less critical warning. Investors are advised to diversify portfolios with inflation-hedging assets like commodities and TIPS as traditional bonds lose appeal.

Uncle Sam's Economic Heartburn: Oil, Inflation, and Market Mayhem

Stagflation is making a comeback with low growth and persistent inflation in the U.S. economy. Global oil markets are in turmoil as sanctions on Venezuela and Iran complicate supply chains. Diversification is crucial for traders in a rapidly changing commodities market; stay flexible and focus on long-term strategies.

China's New Trade Recipe: Add Canadian Exports, Stir in Some Tariffs, Bring to a Boil

China imposes a 100% tariff on Canadian rapeseed oil and 25% on pork and aquatic products starting March 20, complicating trade relations after Canada's tariffs on Chinese goods. Canadian farmers face potential financial strain as cheap access to the Chinese market vanishes, forcing them to seek alternative outlets. Businesses and investors must adapt quickly to the changing trade landscape, focusing on diversification and agility to navigate the new reality.

Market Mayhem 2025: Fed's Sweet Nothings Can't Stop This Rollercoaster

2025 markets are volatile, with some stocks like Allegro Microsystems and Okta soaring 20% while others like Venture Global plummet 39%. Fed Chair Jerome Powell’s unclear signals suggest a choppy market ahead, as inflation and tariffs fuel uncertainty. Investors should prioritize diversification and stay informed to navigate this unpredictable landscape effectively.

India's Rice Export Rules: Breaking Bad News for Some, Breaking Good for Others

India eases its strict ban on broken rice exports, allowing 1.05 million tonnes to aid countries in need, such as Nepal and Senegal. This move reflects India's balancing act between supporting global food security and maintaining domestic rice supplies amidst climate challenges. Traders should keep an eye on rice futures and agri-tech innovations as opportunities arise from this evolving market situation.

Oil Markets Pull a 'Reversal Uno Card' as Geopolitics Stir the Pot

Oil prices are fluctuating wildly with WTI creeping up to $67.04, but facing multi-year lows and geopolitical tensions. OPEC is increasing production by 138,000 barrels per day, causing skepticism about managing supply effectively. With economic forecasts predicting a contraction and fluctuating demand, traders should stay alert and manage risks closely.

Shell's Latest Malaysian Oil Venture: Because 21,000 More Barrels Can't Hurt

Shell's Sabah Deepwater Oil Project Phase 4 aims to produce 21,000 barrels of oil equivalent daily, making a significant impact on the oil market. With ambitious targets for new projects, Shell looks to boost production by 500,000 boepd from 2023 to 2025 amidst global energy market turbulence. Investors should watch Shell and Petronas stocks as Malaysia navigates its fossil fuel and renewable energy strategy.

Gold Glitters While Oil Spills: Markets Keep Everyone Guessing

Gold is thriving at $2,911 per ounce, attracting investors seeking safety amid economic uncertainty. Oil prices are tumbling at $66 per barrel due to trade tensions and recession fears. Central banks are hoarding gold, adding 694 tons in 2024, indicating a strong long-term outlook for the precious metal.

BlockchainFX: The Platform That Makes Binance Look Like Yesterday's Cold Coffee

BlockchainFX (BFX) is challenging Binance with over 500 financial instruments and a unique model that redistributes 70% of trading fees to users. With a prepaid credit card offering purchase limits up to $100,000 and token holders having decision-making power, BFX fosters a community-driven trading environment. Invest early in BlockchainFX to potentially capitalize on its revolutionary approach and exclusive tokenomics before the presale ends.

BlockchainFX: The New Kid Throwing Punches at Binance's Crown

BlockchainFX (BFX) is entering the crypto market with over 500 financial instruments and promises to give back 70% of trading fees to users. They've launched a metal prepaid credit card for convenient spending of digital assets and are capping their token supply at 500 million. The BFX presale whitelist is now open, offering users preferential pricing as the platform aims to compete with Binance.

Markets Go Full Circus as Trump's Trade Policies Keep Everyone on Edge

U.S. markets are struggling with declining consumer sentiment and job cuts, reflecting a tough economic climate. Australian markets continue to decline while emerging markets like India and Brazil show unexpected growth potential. Investors are advised to diversify portfolios to navigate the unpredictable financial landscape ahead.

Vista Gold Greenwashes with ESG Report: Investors Swoon Over Eco-Friendly Mining

Vista Gold's latest ESG Report highlights its commitment to sustainable mining practices, appealing to eco-conscious investors. The Mt Todd Gold Project aims to combine responsible excavating with community support for environmental stewardship. Critics wonder if Vista's green promises are genuine or just clever marketing as they strive to redefine mining standards.

ECB's Rate Cut Party: Lagarde Trades Hawks for Doves

The European Central Bank has cut interest rates by 25 basis points, while Germany announced a €500 billion stimulus package focusing on infrastructure and defense. Renewed trade tensions with the U.S. have caused volatility in the EUR/USD pair, with inflation expectations rising to 2.3% for 2025. The ECB's rate cut signals the start of a complex economic chapter influenced by German fiscal policy and global trade dynamics.

China's Hoarding Spree Meets Zimbabwe's Tobacco Surprise

China is ramping up its strategic commodity reserves, sparking potential price surges in global markets. Zimbabwe's tobacco production is rebounding with a 21% increase expected in 2025, showing resilience despite previous droughts. Investors should diversify supply chains and develop hedging strategies to navigate the evolving commodity landscape.

Uncle Sam's $22.8B Panama Canal Power Play Makes China's Head Spin

BlackRock's $22.8 billion acquisition of Panama Ports signals U.S. intent to counter Chinese influence in a strategic trade route. Controlling 90% of Panama Ports, BlackRock teams up with Global Infrastructure Partners to dominate global shipping traffic. This move illustrates the growing significance of infrastructure investments amid geopolitical tensions, with BlackRock treating assets like solid gold.

Trump's Trade Tantrum Sends Bitcoin Bros Running Back to Gold

Recent tariff announcements have caused chaos in global markets, prompting investors to frantically search for gold as a safer asset. Bitcoin's value dropped 9%, proving it’s moving in tandem with stocks rather than being a reliable safe haven amidst market turmoil. Gold has shown resilience with a 10% year-to-date gain, suggesting that traditional assets may still hold more stability than cryptocurrencies.

Bitcoin Gets Cold Feet as Gold Steals Safe-Haven Spotlight

Bitcoin's recent drop shows it's struggling to maintain its 'safe haven' status, unlike gold which has surged 10% this year. Market uncertainties and risky assets have driven traders back to gold, highlighting Bitcoin's vulnerability. With regulatory discussions looming, the crypto landscape indicates a need to rethink what constitutes a stable investment.

Trump's Trade Tariffs Turn Markets Into Global Financial Pinball

Global markets are tanking amid fears of new U.S. tariffs, with European stocks particularly affected. Despite optimism fading, defense stocks soared by 15% as businesses brace for an uncertain economic landscape. As recession fears rise, investors are turning to gold and defensive stocks while consumer confidence declines.

Crude Oil's Price Roller Coaster Leaves Rupee Feeling Nauseous

OPEC+ is considering increasing oil output, impacting global currency markets and making traders uneasy. The Indian Rupee is struggling due to rising oil prices and capital outflows, while the RBI balances economic factors amidst market volatility. Traders should monitor the correlation between crude prices and currency movements closely as both continue to fluctuate sharply.

Trump's Trade Tariff Turbulence Makes Markets Go 'Wheeeee!'

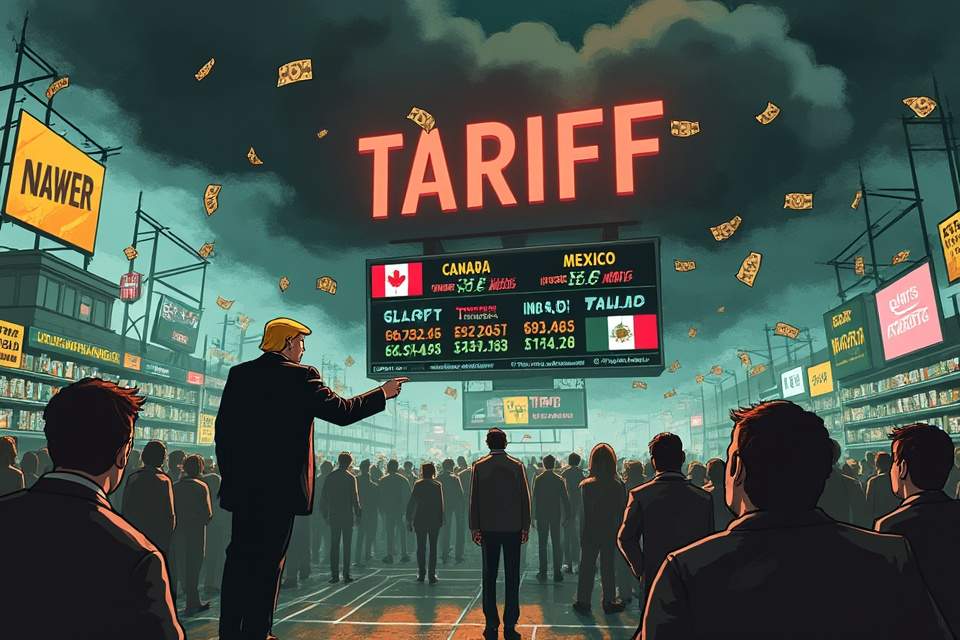

Tariffs have increased significantly, with China's tariffs now at 20% and Canada/Mexico at 25%, hinting at rising consumer prices despite the government's optimistic outlook. Current economic indicators show a decline in GDP and construction spending, while the S&P 500 experiences a 1.8% drop amidst global trade tensions. Investors are flocking to safe havens like gold and Treasury bonds, and amid this chaos, traders should consider diversifying their portfolios as uncertainty looms.

Trump's Tariff Tantrum Tosses Markets Into Trade Tumult

Trump's new 25% tariffs on Mexico and Canada trigger a 1.76% drop in the S&P 500 and threaten to raise consumer prices. China retaliates with its own tariff hike, adding tension to international trade and making corporate America scramble for solutions. Investors are advised to adopt defensive strategies and explore sector-specific ETFs as the trade landscape shifts dramatically.

Palm Oil's Price Plunge Makes Vegetable Kingdom Not-So-Slick

Malaysian palm oil futures are plummeting, with the benchmark contract dropping to 4,390 ringgit amid weak rival oils and geopolitical tensions. Recent price fluctuations hint at ongoing volatility, while supply remains stable despite forecasts of impending low stock levels. Traders should focus on rival oil markets and geopolitical factors, while Malaysian exporters may need to rethink strategies to navigate the current downturn.

Dollar Tumbles as Yen Flexes Its 'Safe Haven' Muscles

The USD/JPY pair is seeing fluctuations as the US dollar weakens following disappointing economic data, especially with the ISM manufacturing index at 50.3. Japan's yen is gaining attention due to a two-year high inflation rate of 4%, prompting the Bank of Japan to take action. Investors are leaning towards safe havens like gold and silver ETFs as markets shift between risk-on and risk-off sentiments.

From Prison Cells to Profit Smells: NY's Cannabis Reform Success

Coss Marte turned his cannabis conviction into a $7 million business with ConBud, symbolizing a significant career pivot from jailbird to entrepreneur. New York's cannabis legalization prioritizes licenses for those affected by the war on drugs, showcasing a push for social equity in the burgeoning $1.5 billion market. As the cannabis industry grows, the challenge remains to ensure that social equity advances alongside profitability to truly benefit communities.

Fed's Money Circus: Gold Glitters While CD Rates Melt Away

The Fed's recent rate cuts make locking in CD rates at 4.60% a wise move as economic forecasts darken. Gold's price fluctuations continue, but Goldman Sachs predicts a rise to $3,100 by year-end. Consider diversifying your investments between CDs and gold, as market stability remains unpredictable.

Gold's Rocky Road: Market Favors Dollar Despite Trump's Tariff Tantrums

Gold prices dropped over 3% to $2,845 amid market volatility and economic uncertainty. President Trump's tariffs and a potential Fed rate cut are shaking up investment confidence, with the dollar becoming the favored safe haven. Traders are keeping an eye on resistance levels and economic indicators as they speculate on the Fed's next moves and gold's future potential.

Trump's Trade Tantrums Make Markets Go Brrr

Trump's trade threats have sent markets into chaos, particularly impacting the AUD/USD exchange rate, which has dropped to around 0.6200. Australia's economy is also feeling the pinch with private capital expenditure shrinking unexpectedly, putting pressure on the Reserve Bank. Gold is tumbling as the USD rises, yet Goldman Sachs forecasts it could hit $3,100 by year-end, highlighting the need for diversification in a turbulent market.

Uncle Sam's Mineral Rights Power Play Has Ukraine Digging Deep

The U.S. and Ukraine have signed a minerals revenue-sharing agreement, ensuring both nations benefit before costs escalate in conflict zones. Negotiation tactics included a threat to cut off satellite internet, highlighting a new form of 'digital diplomacy.' This agreement may reshape global supply chains, particularly in tech metals, renewable energy, and electric vehicles, setting a new precedent for resource sharing in geopolitical partnerships.

Trump's Trade Tantrum Triggers Market Mayhem

Trump's 25% tariffs on Canadian, Mexican, and Chinese imports have sparked market chaos and triggered a drop in European stocks. Inflation is cooling but trade deficits are soaring, complicating the Fed's efforts to maintain stability and manage their 2% target. Traders should consider defensive sectors and gold for safety as the market faces escalating trade tensions and unpredictable dynamics.

Trump's Trade Tantrum Sends Bitcoin on a Rollercoaster Ride

Trump's new 25% tariffs on Canada and Mexico, plus 10% on China, are sending global markets into a tailspin. Tech stocks are struggling, with the Nasdaq dropping post-Nvidia's earnings, while Asian markets fell over 2%. Bitcoin saw a 25% drop, highlighting that even crypto isn't recession-proof amid rising trade tensions.

Trump's Trade-Tastrophe Makes Markets Go Bonkers

Global markets are reacting to President Trump's new tariffs, causing a panic among investors. Traders are flocking to safe-haven assets like gold and the yen as uncertainty rises. Economists warn of potential recessions in Canada and Mexico amid ongoing trade tensions.

Global Superpowers Play Political Twister as UN Watches Helplessly

U.S. and Russia's unexpected alliance at the UN raises eyebrows as Ukraine's conflict nears three years. China's support for Russia and the EU's military aid to Ukraine complicate the geopolitical chessboard. Investors should brace for market turbulence as global alliances shift rapidly amidst ongoing tensions.

MultiBank's Mobile App Conquers Qatar Expo: Desktop Trading Now About as Cool as Fax Machines

MultiBank Group has revolutionized forex trading with its award-winning mobile app, making trading as convenient as ordering takeout. The app offers access to over 20,000 financial instruments and is designed for traders to analyze markets on-the-go. As mobile trading gains popularity, those sticking to desktops may find themselves left behind in the fast-evolving financial landscape.

Trump's Tariff Tirade Triggers Market Mayhem

Trump reintroduces tariffs on Canada and Mexico, possibly imposing 25% on automobiles and semiconductors, shaking up trade dynamics. Consumer confidence is wavering, with retail sales and sentiment dropping, even alarming giants like Walmart. The tech sector faces challenges, and investors are anxiously awaiting Nvidia's earnings in an unpredictable market landscape.

Trump's Trade Tariff Terror: North America's New Game Plan

The U.S. is set to impose a 25% tariff on Canada and Mexico in March, complicating North American trade relations. Automotive prices may surge due to looming tariffs, while businesses rethink local sourcing amidst global supply chain challenges. As international trade tensions rise, companies are increasingly turning to AI and automation to adapt to the changing landscape.

Baltic Ships Signal Market Mojo While Stocks Play Hide-and-Seek

The Baltic Dry Index (BDI) has risen to 841 points, indicating potential growth in global trade despite stock market volatility. Capesize and panamax indices also saw gains, suggesting strong demand for commodities like iron ore and coal, especially in developing nations. Investors should approach cautiously, considering the rising freight rates and current economic conditions while diversifying their portfolios.

Sprott's Latest Numbers Leave Market Yawning Despite Golden Performance

Sprott Inc reported a strong quarterly EPS of C$0.46 with a 28.20% net margin, but the market barely reacted, nudging shares up just 0.2%. Despite impressive liquidity ratios, Sprott's high debt-to-equity ratio raises concerns, leaving investors cautious about the alternative asset sector. Analysts are optimistic, but the muted market reaction suggests potential risks for those considering Sprott as a portfolio addition.

Trump's Copper Crusade: Metal Markets Brace for Yet Another Trade Tumble

Trump has initiated an investigation into copper imports, aiming to impose tariffs similar to those on steel and aluminum. The focus on copper could raise costs for industries relying on it, while businesses adapt to reshaping supply chains. These trade tensions may benefit U.S. copper producers but could create new challenges in international trade relationships.

Trump's Trade Tantrums Tank Bitcoin Below $92,000

Bitcoin and Ethereum prices plummeted amid Trump's new tariffs, triggering nearly $900 million in liquidations. Traders are shifting from derivatives to spot markets as concerns grow, with the Crypto Fear & Greed Index at a low of 25. While crypto struggles, gold is hitting all-time highs, proving that traditional assets still hold strong in turbulent times.

Market Jitters: Trump's Tariff Threat Sends Everyone Reaching for Antacids

2025's market forecasts are shaky with U.S. GDP growth potentially dropping to 1% amid tariff threats. Investors are rapidly selling off assets as volatility spikes and currency values fluctuate drastically. Despite the turmoil, some U.S. sectors show resilience, urging investors to stay flexible and balanced.

Shell's Crystal Ball Says LNG Will Be Life of the Party Till 2040

Shell's latest LNG forecast predicts a 60% surge in demand by 2040, primarily driven by Asia's increasing appetite for natural gas. China and India are rapidly expanding LNG import facilities, with India aiming to increase gas consumption by 60% by 2030. The U.S. has become the top global LNG supplier, making LNG a vital player in the evolving energy landscape, despite regulatory and logistical challenges ahead.

South Korea's Rate Cut Theatre: BOK Goes Low While Japan's PPI Steals the Show

South Korea's Bank of Korea is set for a rate cut amidst rising inflation pressures, while Japan faces a 4.2% Producer Price Index increase. The BOK's monetary easing risks currency devaluation as they attempt to stimulate domestic demand in a tricky post-pandemic economy. Investors should stay agile, focusing on equity and forex markets, as South Korean tech stocks and inflation-linked bonds gain attention.

Putin's Rare Earth Pitch Meets Digital Gold Rush: Global Commodity Markets Get Spicy

Russia offers rare earth mineral collaboration to the U.S., potentially disrupting China's supply dominance. The U.S. aims to reduce reliance on Chinese resources, while Thailand emerges as a digital gold trading hub. The 2025 commodity market is evolving rapidly, blending geopolitics with digital innovation.

Rand's Wild Rollercoaster Leaves Traders Reaching for Gold (and Aspirin)

The South African rand is experiencing volatility, influenced by budget delays and high gold prices acting as a stabilizing force. A weaker U.S. dollar aids the rand, but upcoming U.S. inflation reports could disrupt market conditions. South African consumers face low confidence amid rising living costs, prompting policymakers to restore optimism as investors watch for key economic indicators.

Gold Glitters While Dollar Sulks: A South African Money Story

Gold shines during dollar's slump, driven by disappointing economic data and geopolitical tensions. Federal Reserve remains hawkish, posing risks to gold as rising Treasury yields loom. Diversify your portfolio and stay cautious; market volatility is the name of the game.

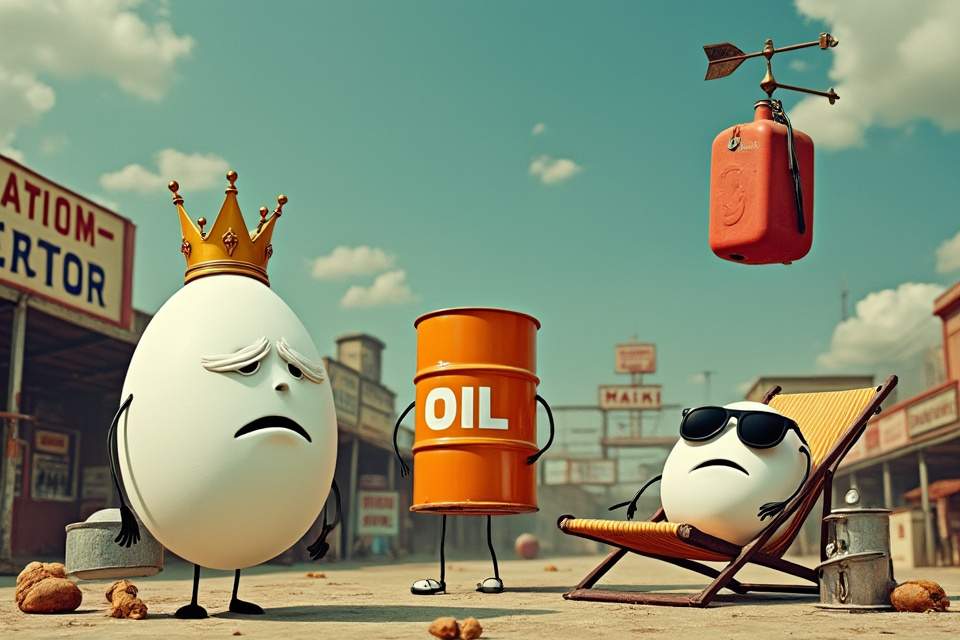

Market's Triple Threat: Eggs, Oil, and Gas Play Hot Potato with Prices

Egg prices are skyrocketing due to avian flu, with consumers still buying in droves despite steep costs. Oil prices have dropped to $70.40 per barrel amidst economic uncertainty, while traders brace for potential geopolitical shifts. Natural gas prices are fluctuating as traders react to changing weather forecasts and inventory levels.

Commodity Markets Play Hot & Cold: Oil Sulks While Gold Shines

Crude oil is struggling with a drop to $70.40 due to a strong dollar and economic worries, while natural gas gains 1.97% thanks to favorable weather forecasts. Gold is on an eight-week winning streak, approaching $2,877 and aiming for $3,000, driven by high safe-haven demand. Traders should focus on economic data and diversification to navigate the volatile commodity market.

Oracle of Omaha Goes Full Sushi Mode with Japanese Trading Houses

Warren Buffett is expanding his investments in Japanese trading houses despite Mitsubishi's recent decline, showing confidence in the long-term potential of these firms. His yen-denominated bond strategy has yielded $2.3 billion in gains, showcasing a savvy approach to currency investments. Investors may want to follow Buffett's lead and consider Japanese equities, which are increasingly appealing due to corporate reforms and fiscal stimulus.

Oil's Wild Rollercoaster Defies Market's Comfort Zone

Geopolitical tensions, like the Caspian Pipeline woes, are shaking up oil supply and causing prices to fluctuate wildly. U.S. crude inventories are on the rise due to refinery maintenance, leading to unpredictable dynamics in the market. As we head into 2025, traders should closely monitor the Russia-Ukraine situation, U.S. inventories, and weather patterns for market insights.

Oil's Wild Ride Makes Traders Pull Their Hair Out

Brent and WTI crude prices are fluctuating significantly due to geopolitical tensions, particularly with Ukraine's drone incidents affecting oil supply. Market analysts are concerned about potential Russian oil sanctions as Trump's criticisms of Zelenskiy might lead to increased Russian crude in the market. Traders should remain adaptable and cautious as U.S. inventory data and external factors like cold weather are causing unpredictable shifts in oil prices.

Cocoa's Epic Sugar High Comes Crashing Down

Cocoa prices have dropped from $12,600 to below $9,600 per tonne due to disappointing harvests and supply chain chaos in West Africa. Chocolate giants are anticipating price hikes, possibly making candy bars more expensive than streaming subscriptions. Market trading in cocoa is unpredictable, influenced by supply issues and shifting consumer demand for chocolate amid rising costs.

Trump's Gas Gambit: Uncle Sam Wants Japan to Buy His LNG

Trump aims to sell more American gas to Japan, positioning the U.S. as Asia's energy supplier. The Alaska LNG project faces significant challenges, but it's part of a broader strategy to engage Asian markets. As Japan, South Korea, and India consider American LNG, the global energy trade could shift significantly.

P&G's Global Rollercoaster: Even Soap Can't Wash Away Market Woes

P&G's shares dropped 2.2% as CFO warns of lower annual earnings due to external challenges. Tariffs, currency fluctuations, and rising interest rates complicate their global operations. Despite inventory issues, P&G's brand loyalty remains strong, presenting potential long-term investment opportunities.

Gold Shines While Gas Tanks: 2025's Economic Seesaw

U.S. natural gas inventories have plunged by 196 Bcf, raising concerns over rising heating costs this winter. Gold prices are soaring past $2,200 per ounce as investors seek refuge amid economic uncertainty. Diversification in investments—particularly in precious metals and utility stocks—is crucial for navigating the current economic volatility.

Gold's Glittering Gambit: Traders Bet Big as Metal Breaks Records

Gold prices have skyrocketed to $2,946 per ounce amid economic uncertainty and tariff announcements. Central bank gold purchases rose 54% year-over-year, with China leading the charge. Geopolitical tensions are boosting gold's appeal, while silver is gaining traction as a potential sleeper investment.

Gold and Oil's Mad Market Circus as Tariffs Loom

Gold is breaking away from its traditional ties to the U.S. dollar, potentially soaring past $3,000 per ounce amid rising tariffs and economic concerns. WTI crude oil could face volatility if a U.S.-Russia peace deal leads to a surge of Russian oil in the market. With the U.S. dollar remaining stable, traders should stay nimble and informed, as Q2 2025 promises unpredictable market dynamics.