Brazil's Real Goes Global: SGX and B3's Currency Power Play

SGX and B3 team up to offer 24/7 trading of the Brazilian real, allowing traders to hedge against Brazil's economic fluctuations. Brazil's government removes import taxes on essential goods to combat inflation and boost market stability. This collaboration simplifies access to trading emerging market currencies, presenting new opportunities for investors eyeing Brazil's economic growth.

Dollar Takes a Nosedive While Euro Smugly Sips Tea

The US Dollar hits a four-month low of 103.85 amid inconsistent economic data and new policies from Trump. The Euro rises to 1.0850 against the USD, boosted by positive Eurozone data and ECB's successes. Traders should diversify portfolios with Euro assets as market volatility increases in bonds and currencies.

Dollar's Rocky Road: Trump's Return Spooks Markets as Euro Parties On

The US Dollar is experiencing a downturn, hitting a four-month low as traders anticipate rate cuts by the Fed. The Euro and British Pound are gaining strength against the Dollar, while the Yen acts as a safe haven amid rising trade tensions. Investors should stay alert to economic indicators and market volatility, as trends can shift rapidly in currency markets.

Uncle Sam's Market Magic Show Hits Turbulence

The U.S. market is showing signs of weakness, with the S&P 500 declining and the dollar dropping 4% since January. Trade policies are creating uncertainty, increasing recession fears and making market volatility a key concern. As Europe invests heavily and China's tech sector rises, diversifying investments beyond the U.S. is becoming more critical for future stability.

Dollar's Wild Ride: Fed, Trump, and the Art of Currency Chaos

Central banks are showcasing indecision as global monetary policies zigzag, leaving traders in confusion. The U.S. dollar is struggling after disappointing nonfarm payrolls, while Europe makes a surprising comeback with the euro's rise. Amidst the chaos, smart traders are adapting to uncertainty, looking for opportunities in a volatile forex market.

Uncle Sam's Dollar Gets European Reality Check

U.S. economy is shrinking at a 2.4% rate, while the dollar weakens and European assets become more attractive to investors. Germany's DAX Index now outperforms the S&P 500, signaling a shift from U.S. to European markets. With the European Central Bank cutting rates and improving defense spending, now might be the time to diversify portfolios toward Europe.

Central Banks Play Hide and Peek with Interest Rates

Central bankers play poker with interest rates while signaling mixed messages about the economy, as the US job market falls short of expectations. Deutsche Bank takes a neutral euro stance while Germany hints at increased defense spending, and the ECB prepares for potential rate cuts. With global economic uncertainties and looming tariffs, Forex traders must navigate a complex landscape of indicators and central bank communications.

Dollar Flexes While Aussie Goes Walkabout

US job growth disappointed with only 151,000 new jobs in January, prompting a downgrade in GDP forecasts to 1.5%. China's unexpected 8.4% drop in imports is causing economic jitters for Australia, with the AUD struggling against the USD. Traders should remain flexible as market conditions shift rapidly, with safe-haven currencies gaining appeal amidst global trade tensions.

BlockchainFX: The Platform That Makes Binance Look Like Yesterday's Cold Coffee

BlockchainFX (BFX) is challenging Binance with over 500 financial instruments and a unique model that redistributes 70% of trading fees to users. With a prepaid credit card offering purchase limits up to $100,000 and token holders having decision-making power, BFX fosters a community-driven trading environment. Invest early in BlockchainFX to potentially capitalize on its revolutionary approach and exclusive tokenomics before the presale ends.

BlockchainFX: The New Kid Throwing Punches at Binance's Crown

BlockchainFX (BFX) is entering the crypto market with over 500 financial instruments and promises to give back 70% of trading fees to users. They've launched a metal prepaid credit card for convenient spending of digital assets and are capping their token supply at 500 million. The BFX presale whitelist is now open, offering users preferential pricing as the platform aims to compete with Binance.

Trump's Trade Tantrums: Markets Brace for Tariff 2.0

President Trump's new tariffs are causing market chaos, with a significant trade deficit and industry concerns over rising costs. The Federal Reserve faces tough decisions as economic uncertainty looms, making gold a potentially safe investment. Global markets must adapt to increasing protectionist policies, while industries scramble to mitigate the impact of trade disputes.

Trump's Tariff Tease Sends Aussie Dollar into Dizzy Fit

Tariffs are causing volatility in the AUD/USD forex pair as President Trump extends exemptions for Canada and Mexico, leaving traders and global partners in suspense. The AUD remains vulnerable due to its dependence on Chinese commodity exports, with recent economic data painting a mixed picture. Traders should stay alert to geopolitical developments and consider risk management strategies amid uncertainties in the market.

Trump's Trade Tirade Triggers Market Mayhem

President Trump's trade policy tweets trigger a dramatic 467-point drop in the Dow Jones, as new tariffs create market chaos. Bonds are no longer boring, with U.S. Treasury yields and German Bunds experiencing extreme volatility amid inflation concerns. The dollar hits a four-month low against the euro, signaling increased uncertainty in global markets and rising costs for automotive and tech sectors.

ECB's Rate Cut Party: Lagarde Trades Hawks for Doves

The European Central Bank has cut interest rates by 25 basis points, while Germany announced a €500 billion stimulus package focusing on infrastructure and defense. Renewed trade tensions with the U.S. have caused volatility in the EUR/USD pair, with inflation expectations rising to 2.3% for 2025. The ECB's rate cut signals the start of a complex economic chapter influenced by German fiscal policy and global trade dynamics.

Japanese Bonds Hit Peak Comedy: JGB Yields Go Wild as BoJ Joins Rate Hike Club

Japanese 10-year JGB yields have surged past 1.5%, shaking up the market and leaving analysts stunned. As inflation hits 4%, Japanese investors are off buying foreign bonds, treating global markets as a buffet. With capital fleeing Japanese stocks and the BoJ's balance sheet swelling, all eyes are on upcoming U.S. and Japanese economic data.

Down Under Markets Play Hide and Shriek

Australia 200 Index dropped 63 points to 8,077, losing 11 of the last 14 trading sessions while Wall Street thrives. Trump's tariffs on China could destabilize Australia's economy despite a recent 1.40% gain in the Aussie Dollar. The energy and banking sectors are struggling, and traders should keep portfolios diversified as global trade tensions rise.

Euro Goes Full Beast Mode as Dollar Gets German-Slapped

Germany's €500 billion infrastructure fund sends the euro skyrocketing as the EUR/USD pair gains 3.70% this week. Trump's tariffs weaken the US dollar amidst a dip in manufacturing, creating a volatile forex environment. With technical indicators suggesting further euro strength, traders should stay vigilant as the market remains unpredictable.

BOJ's Money Printer Goes 'Brrr... Wait, Stop!'

Japan's Bank of Japan is expected to raise interest rates as officials signal a shift from the long-held zero-interest-rate policy. The Japanese Yen is showing strength amidst economic challenges, influencing global markets as they prepare for potential shifts in bond yields. Investors should stay alert to these monetary changes, as they could significantly impact global financial strategies and sector resilience.

Yen's Wild Adventure: JPY Pairs Show Financial Markets Who's Boss

The USD/JPY pair struggles to break above 150.00, with potential drops to 148.57 or 141.64 if resistance holds. The AUD/JPY is under pressure at 92.00, with a drop below this level likely causing panic among traders. The Bank of Japan is shifting from ultra-loose policies as inflation rises, positioning the Yen as a potential safe haven in turbulent markets.

Crude Oil's Price Roller Coaster Leaves Rupee Feeling Nauseous

OPEC+ is considering increasing oil output, impacting global currency markets and making traders uneasy. The Indian Rupee is struggling due to rising oil prices and capital outflows, while the RBI balances economic factors amidst market volatility. Traders should monitor the correlation between crude prices and currency movements closely as both continue to fluctuate sharply.

Trump's Tariff Tantrum Sends Dollar Down Memory Lane

Trump's new tariffs are causing chaos in the forex market, prompting dramatic shifts in currency values. The USD is struggling while the GBP surprisingly thrives above 1.2700, amid troubling economic indicators. Traders should stay alert as market volatility continues, with significant changes happening faster than expected.

Trump's Tariff Tantrum Sends Pound and Dollar on Wild Currency Rollercoaster

GBP/USD is steady at 1.2600 as traders react to Trump's tariff threats, causing anxiety in the markets. Today's ISM Manufacturing PMI is crucial; a dip below 50 could weaken the dollar, while a strong reading might bolster it. With GDP forecasts dwindling and volatile yields, GBP/USD traders should watch the 1.2715 resistance and stay agile in this unpredictable market.

Dollar Tumbles as Yen Flexes Its 'Safe Haven' Muscles

The USD/JPY pair is seeing fluctuations as the US dollar weakens following disappointing economic data, especially with the ISM manufacturing index at 50.3. Japan's yen is gaining attention due to a two-year high inflation rate of 4%, prompting the Bank of Japan to take action. Investors are leaning towards safe havens like gold and silver ETFs as markets shift between risk-on and risk-off sentiments.

Dollar Takes a Nosedive as Europe Steals the Show

The dollar dropped 0.95% amid disappointing economic data, prompting markets to reconsider rate cut expectations. The euro gained strength on positive Eurozone news, while the yen could see rate hikes due to rising inflation. Traders should diversify their investments and stay alert to economic indicators as market uncertainty continues.

Iran's Economic Hotseat Claims Another Victim as Inflation Soars

Iran's economy minister was dismissed as the rial plummets and inflation hits 35%, highlighting deep economic issues. President Pezeshkian's administration faces criticism and chaos amid U.S. sanctions and regional tensions. The political turmoil reflects broader economic challenges, suggesting market watchers should be vigilant and adaptable.

Iran's Economic Minister Gets Fired into Orbit as Currency Hits Rock Bottom

Iran's parliament ousted Economy Minister Abdolnaser Hemmati amid soaring inflation and a plunging rial, signaling economic turmoil ahead. With the rial now valued at 950,000 to the dollar, investors are advised to diversify and prepare for instability in the Iranian market. Political infighting and external pressures add complexity to Iran's economic landscape, making adaptability essential for survival.

ECB and BOJ Square Off in March's Monetary Policy Showdown

The ECB is likely to cut rates by 25 basis points at their March 6 meeting amidst rising inflation, while the Yen makes a surprising comeback against the USD, though a rate hike from the BOJ is highly unlikely. Technical analysis suggests heightened volatility in forex markets as traders brace for central bank decisions; managing risk will be essential in navigating these unpredictable waters.

Interest Rates: Fed Takes a Nap While Europe Hits Snooze

The Federal Reserve takes a break from rate hikes while the European Central Bank plans to slash rates, possibly weakening the euro against currencies like the Swedish krona. The Bank of Japan joins the rate-hiking trend amidst concerns over rising debts and slowing economic growth. Investors should watch regional interest rate differences and emerging sectors influenced by cheaper loans, as the global financial landscape evolves.

Trump's Trade Tantrums Make Markets Go Brrr

Trump's trade threats have sent markets into chaos, particularly impacting the AUD/USD exchange rate, which has dropped to around 0.6200. Australia's economy is also feeling the pinch with private capital expenditure shrinking unexpectedly, putting pressure on the Reserve Bank. Gold is tumbling as the USD rises, yet Goldman Sachs forecasts it could hit $3,100 by year-end, highlighting the need for diversification in a turbulent market.

Trump's Trade Tantrum Triggers Market Mayhem

Trump's 25% tariffs on Canadian, Mexican, and Chinese imports have sparked market chaos and triggered a drop in European stocks. Inflation is cooling but trade deficits are soaring, complicating the Fed's efforts to maintain stability and manage their 2% target. Traders should consider defensive sectors and gold for safety as the market faces escalating trade tensions and unpredictable dynamics.

India and Japan's $75 Billion Currency Bromance Gets a Glow-Up

India and Japan renewed their $75 billion currency swap deal, strengthening financial ties and reducing reliance on the US dollar. This arrangement could smooth out volatility in the INR/JPY forex pair and encourage other nations to form similar partnerships. The deal emphasizes international cooperation, promising to reshape the global financial landscape and warranting close attention from traders.

Trump's Trade-Tastrophe Makes Markets Go Bonkers

Global markets are reacting to President Trump's new tariffs, causing a panic among investors. Traders are flocking to safe-haven assets like gold and the yen as uncertainty rises. Economists warn of potential recessions in Canada and Mexico amid ongoing trade tensions.

Kiwi Dollar Gets Tariff-ied: NZD Takes a Nosedive Against USD

The New Zealand Dollar is experiencing significant losses, influenced by President Trump's renewed tariff threats. Technical indicators suggest potential further decline for the NZD/USD pair if key support levels are breached. Traders should remain vigilant, monitor support levels closely, and prepare for market volatility amid U.S. trade policy uncertainty.

Prop Trading's Great Purge: 100 Firms Say Bye-Bye to Their Bottom Line

The prop trading industry faces turmoil with 100 firms shutting down in 2024, prompting experts to anticipate more closures in 2025. While some firms are consolidating, average investments have plummeted by 50%, making the landscape increasingly exclusive for traders. As new platforms challenge MetaTrader's dominance, aspiring traders must choose wisely and prepare for a tumultuous market ahead.

MultiBank's Mobile App Conquers Qatar Expo: Desktop Trading Now About as Cool as Fax Machines

MultiBank Group has revolutionized forex trading with its award-winning mobile app, making trading as convenient as ordering takeout. The app offers access to over 20,000 financial instruments and is designed for traders to analyze markets on-the-go. As mobile trading gains popularity, those sticking to desktops may find themselves left behind in the fast-evolving financial landscape.

Trump's Trade Tantrum Sends Markets Into Meltdown Mode

Trump's tariff threats on Canada and Mexico could lead to 25% tariffs, alarming Wall Street. Consumer confidence is waning, with retail sales dropping and economic sentiment souring. Tech sector struggles and Bitcoin's nosedive add to market uncertainty; stay vigilant in these turbulent times.

EUR/USD: Market Squeeze or Just Another Wall Street Sneeze?

Deutsche Bank shifts to a neutral stance on the euro, hinting at potential market volatility fueled by Germany's defense fund boost. The EUR/USD is flirting with key technical levels, suggesting potential bullish moves if it breaks above 1.0550. Traders must stay vigilant as the ECB and Fed's monetary policies create uncertainty, with support at 1.0450 as a safety net.

EUR/USD's Wild Rodeo Has Bulls and Bears Trading Punches

The EUR/USD pair is experiencing wild fluctuations, with traders on edge as it struggles around key technical levels. U.S. economic data is underwhelming, prompting uncertainty about the Federal Reserve's next move amid upcoming reports. The ECB is balancing its dovish stance while traders anticipate potential rate cuts, making 1.04529-1.05325 the crucial trading range.

USD and JPY's Money Fight: Central Banks Enter the Ring

The USD/JPY exchange rate is facing volatility as the US Fed hints at rate cuts while Japan's central bank contemplates rate hikes. Consumer confidence in the US has plummeted, pushing the dollar to 149.02 against the yen amidst rising inflation expectations. Japanese demand for USD remains strong, potentially supporting the currency despite looming risks of a drop below the 150.00 mark.

Market Jitters: Trump's Tariff Threat Sends Everyone Reaching for Antacids

2025's market forecasts are shaky with U.S. GDP growth potentially dropping to 1% amid tariff threats. Investors are rapidly selling off assets as volatility spikes and currency values fluctuate drastically. Despite the turmoil, some U.S. sectors show resilience, urging investors to stay flexible and balanced.

Trump's Trade Tiff 2.0: Markets Shrug While Dollar Takes a Power Nap

Trump's latest tariff threats are met with market indifference, showing a 'meh' attitude rather than panic. Bond markets are calming down, with treasury yields below 4.40%, indicating inflation fears are fading. Traders are skeptical about the actual impact of these tariffs, expecting them to be less threatening than anticipated.

Trump's Tariff Show: Markets Shrug While Portfolios Squirm

Trump's tariff threats on Canadian and Mexican imports in 2025 are being met with indifference from the markets, as traders show more interest in coffee than panic. Despite a potential market correction predicted by hedge fund managers, savvy investors are urged to focus on defensive strategies and diversification rather than panic-selling. Upcoming economic reports, including Nvidia earnings and U.S. consumer confidence, may overshadow the tariff drama, making it essential for investors to stay balanced.

South Korea's Rate Cut Theatre: BOK Goes Low While Japan's PPI Steals the Show

South Korea's Bank of Korea is set for a rate cut amidst rising inflation pressures, while Japan faces a 4.2% Producer Price Index increase. The BOK's monetary easing risks currency devaluation as they attempt to stimulate domestic demand in a tricky post-pandemic economy. Investors should stay agile, focusing on equity and forex markets, as South Korean tech stocks and inflation-linked bonds gain attention.

Rand's Wild Rollercoaster Leaves Traders Reaching for Gold (and Aspirin)

The South African rand is experiencing volatility, influenced by budget delays and high gold prices acting as a stabilizing force. A weaker U.S. dollar aids the rand, but upcoming U.S. inflation reports could disrupt market conditions. South African consumers face low confidence amid rising living costs, prompting policymakers to restore optimism as investors watch for key economic indicators.

Gold Glitters While Dollar Sulks: A South African Money Story

Gold shines during dollar's slump, driven by disappointing economic data and geopolitical tensions. Federal Reserve remains hawkish, posing risks to gold as rising Treasury yields loom. Diversify your portfolio and stay cautious; market volatility is the name of the game.

CFD Brokers Unleash 2025's Battle Royale for Trader Hearts

Versus Trade enters the CFD trading scene with competitive spreads and innovative strategies, aiming to capture traders' attention in 2025. XS.com counters with advanced AI features and loyalty programs, ensuring they remain a formidable presence in the market. Mitrade focuses on trader safety with excess loss insurance, proving that in a volatile environment, protection can be profitable.

Buffett's Love Letter to Japan: Oracle Goes Full Sushi on Trading Houses

Warren Buffett has significantly invested in Japanese trading houses, growing his investment from $13.8 billion to $23.5 billion since 2019. Buffett lifted the 10% ownership limit on these trading houses, recognizing their similar operational style to Berkshire Hathaway. Looking forward to 2025, Berkshire anticipates $812 million in annual dividends, showcasing Buffett's long-term strategic investment approach.

Warren's Wacky Japanese Shopping Spree Hits $23.5 Billion

Warren Buffett is increasing his investment in Japan's largest trading houses, with Berkshire Hathaway's holdings projected to reach $23.5 billion by the end of 2024. Buffett's strategic move into yen-denominated bonds has resulted in significant gains and a forecasted annual dividend income of $812 million. As Japan's corporate landscape undergoes changes, Buffett's long-term commitment indicates ripe investment opportunities in the market.

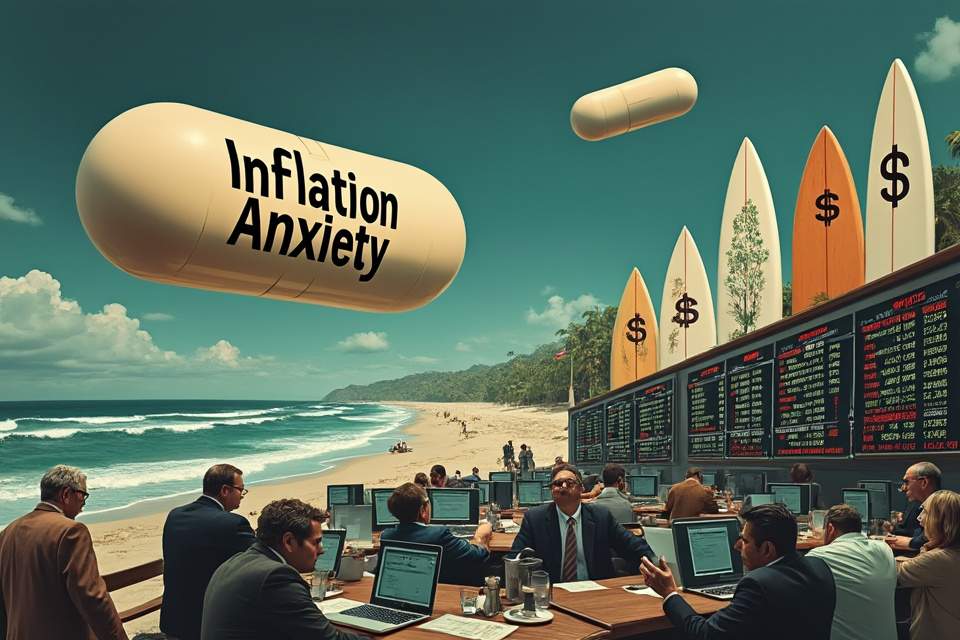

Market's Inflation Anxiety Pills Not Working

Inflation expectations are at a 30-year high, with consumers anticipating a 3.5% annual rate, causing market volatility. The S&P 500 is declining as investors seek safer options and skepticism in the market rises, particularly in tech stocks. To navigate these challenges, investors should consider diversifying into defensive sectors, adding inflation-protected securities, and monitoring consumer sentiment.

Yen's Hot Date with Inflation Makes BOJ Break its Zero-Interest Habits

Japan's central bank may end its zero interest rate policy as inflation hits 4.2%, prompting a reevaluation of monetary strategy. The yen strengthens against the dollar amid disappointing U.S. economic performance and potential Fed rate cuts. Traders should watch the yen closely, particularly around the 149.00 mark, while staying poised for rapid market changes.

Options Expiry Day: $2.7 Trillion Worth of Market Butterflies

Wall Street braces for a massive $2.7 trillion options expiration, sparking fears of extreme volatility. Former President Trump's tariff threats add fuel to the fire, causing frantic trading among investors. With seasonal declines and looming tax payments, traders are advised to adopt a defensive strategy and tighten risk management.

RBI's $10 Billion Money Splash Has Banks Swimming in Rupees

The Reserve Bank of India is injecting ₹87,000 crore into the financial system through $10 billion in long-term dollar-rupee swap auctions over three years, addressing a significant liquidity deficit. This strategic move aims to strengthen market stability and may attract foreign investments, while the Indian Rupee could potentially recover to 87.00 if it maintains its position. Investors are optimistic as the RBI's intervention is seen as a necessary stabilizing force for the Indian financial markets amidst external pressures.

RBA's Interest Rate Cut: Kangaroo Economy Bounces Lower

The RBA cuts interest rates to 4.1% for the first time since early 2021, following a drop in inflation from 7.8% to 2.4%. Despite a stable job market and increased employment, further rate cuts will depend on upcoming economic data. Market analysts are divided on future cuts, with the AUD poised for movement amid improving trade conditions and upcoming inflation reports.

Yen's Revenge: Dollar Takes a Nosedive as Japan Flexes Its Monetary Muscles

The USD/JPY has plummeted to 149.29, causing panic among forex traders as the dollar slips below the 150 yen mark. The Bank of Japan is hinting at policy changes amid rising JGB yields, disrupting the usual forex expectations. With the Fed on hold, external factors like Trump's tariffs are intensifying market volatility and uncertainty around the yen's future.

P&G's Global Rollercoaster: Even Soap Can't Wash Away Market Woes

P&G's shares dropped 2.2% as CFO warns of lower annual earnings due to external challenges. Tariffs, currency fluctuations, and rising interest rates complicate their global operations. Despite inventory issues, P&G's brand loyalty remains strong, presenting potential long-term investment opportunities.

Foreign Investors Ghost India While Locals Keep Swiping Right

Foreign Portfolio Investors are rapidly selling off Indian equities, with Rs 98,229 crore leaving in January alone. While FPIs flee towards U.S. stocks, domestic investors continue buying, hinting at optimism in sectors like healthcare and consumer goods. AI is aiding traders in navigating market volatility, suggesting that adaptability and tech tools could be key for future success.

Gold and Oil's Mad Market Circus as Tariffs Loom

Gold is breaking away from its traditional ties to the U.S. dollar, potentially soaring past $3,000 per ounce amid rising tariffs and economic concerns. WTI crude oil could face volatility if a U.S.-Russia peace deal leads to a surge of Russian oil in the market. With the U.S. dollar remaining stable, traders should stay nimble and informed, as Q2 2025 promises unpredictable market dynamics.

Forex Markets: Pound Sterling & Yen Flirt with Economic Reality

The British Pound is fluctuating against the US Dollar, with critical support at 1.2525; a drop below could lead to further declines. The Federal Reserve's stance is uncertain, juggling inflation and steady employment without clear direction on rate changes. The Japanese Yen is gaining strength as the Bank of Japan shifts its approach, and traders should watch the USD/JPY pair closely for potential moves.

Down Under's Dollar Takes a Trump-Sized Tumble

Australia's unemployment rate rose to 4.1% in January, showcasing economic challenges despite a job creation boost. The Australian dollar dropped to 0.6340 against the USD amid Trump’s tariff threats, sparking trade worries. The Reserve Bank of Australia cut its cash rate to 4.10%, navigating a turbulent economic landscape with a mix of job growth and inflation concerns.

Trump's Trade Tantrums Make Dollar Go Brrrr

Trump's new 25% tariffs on cars and pharmaceuticals boost the USD/CAD pair above 1.4200, creating anxiety among Canadian traders. The Federal Reserve is cautious about rate cuts, impacting the dollar's strength against the loonie. Canada faces inflation challenges at 1.9%, complicating its monetary easing plans amidst U.S. tariff threats.